The 6-Minute Rule for Amur Capital Management Corporation

The 6-Minute Rule for Amur Capital Management Corporation

Blog Article

Amur Capital Management Corporation - Truths

Table of ContentsAn Unbiased View of Amur Capital Management CorporationThe 3-Minute Rule for Amur Capital Management CorporationA Biased View of Amur Capital Management CorporationAmur Capital Management Corporation Can Be Fun For EveryoneAmur Capital Management Corporation Things To Know Before You BuyAmur Capital Management Corporation for Beginners

The firms we adhere to require a solid performance history usually at least ten years of operating background. This implies that the business is likely to have actually faced at the very least one economic downturn and that monitoring has experience with hardship as well as success. We look for to omit firms that have a credit top quality below financial investment grade and weak nancial strength.A company's capacity to elevate returns regularly can demonstrate protability. Business that have excess cash ow and strong nancial positions typically select to pay returns to bring in and award their investors. As a result, they're commonly less volatile than supplies that don't pay rewards. Beware of reaching for high returns.

Amur Capital Management Corporation - Truths

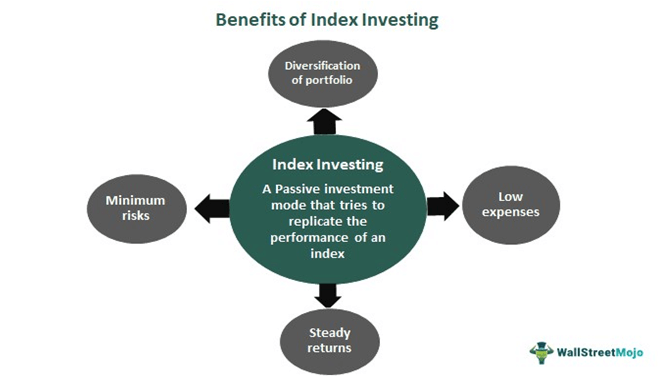

We've found these supplies are most in danger of cutting their returns. Diversifying your investment profile can assist shield versus market uctuation. Check out the following aspects as you plan to branch out: Your profile's asset class mix is among one of the most essential elements in establishing performance. Look at the dimension of a firm (or its market capitalization) and its geographical market U.S., established worldwide or arising market.

In spite of exactly how very easy electronic investment administration systems have actually made investing, it shouldn't be something you do on an impulse. If you choose to enter the investing world, one thing to consider is how long you really desire to spend for, and whether you're prepared to be in it for the long haul - https://experiment.com/users/amurcapitalmc.

There's an expression common linked with investing which goes something along the lines of: 'the ball may drop, yet you'll want to make sure you're there for the bounce'. Market volatility, when financial markets are going up and down, is a typical sensation, and long-lasting might be something to help smooth out market bumps.

Fascination About Amur Capital Management Corporation

With that said in mind, having a long-lasting approach might assist you to take advantage of the wonders of substance returns. Joe invests 10,000 and makes 5% reward on this financial investment. In year one, Joe makes 500, which is repaid into his fund. In year two, Joe makes a return of 525, since not just has he made a return on his preliminary 10,000, but also on the 500 invested dividend he has made in the previous year.

Amur Capital Management Corporation for Beginners

One means you might do this is by getting a Supplies and Shares ISA. With a Supplies and Shares ISA. mortgage investment, you can spend approximately 20,000 annually in 2024/25 (though this undergoes change in future years), and you do not pay tax obligation on any returns you make

Getting started with an ISA is really simple. With robo-investing platforms, like Wealthify, the effort is done for you and all you need to do is pick exactly how much to spend and pick the risk degree that fits you. It might be among minority circumstances in life where a much less emotional method can be beneficial, however when it involves your funds, you may wish to listen to you head and not your heart.

Staying concentrated on your lasting objectives might assist you to stay clear of unreasonable choices based upon your feelings at the time of a market dip. The data don't lie, and lasting investing could feature many advantages. With a composed technique and a lasting financial investment approach, you can possibly expand also the tiniest amount of cost savings into a respectable sum of money. The tax obligation treatment depends upon your individual conditions and might undergo you could try this out transform in the future.

Not known Details About Amur Capital Management Corporation

Nonetheless spending goes one step further, assisting you accomplish individual objectives with three significant benefits. While conserving means establishing aside component of today's money for tomorrow, investing means placing your money to work to possibly make a far better return over the longer term - alternative investment. https://www.webtoolhub.com/profile.aspx?user=42387048. Various courses of investment assets cash, dealt with interest, property and shares normally create various levels of return (which is relative to the danger of the financial investment)

As you can see 'Growth' assets, such as shares and building, have traditionally had the finest general returns of all property classes but have likewise had bigger heights and troughs. As a financier, there is the potential to gain resources growth over the longer term in addition to a continuous income return (like dividends from shares or rent out from a home).

See This Report about Amur Capital Management Corporation

Rising cost of living is the ongoing increase in the expense of living in time, and it can influence on our monetary well-being. One means to aid exceed inflation - and create favorable 'actual' returns over the longer term - is by buying possessions that are not just qualified of supplying higher income returns however additionally supply the capacity for resources growth.

Report this page